Welcome to the May edition of the DeQuantifi monthly newsletter. Each month, we bring you a summary of the crypto news from a UK and European perspective, along with a feature article, where we discuss a topic in depth.

This month, we discuss rising transaction fees and processing times on Bitcoin and Ethereum. In our feature article we take a look at Cross Chain Interoperability, and of course we bring you our usual summary of the month’s crypto news.

Bitcoin and Ethereum Fees Increase Due to Ordinals and Memecoins

Bitcoin transaction volumes (and fees and processing times) surged in April and May due to the impact of ordinals and BRC-20, even as trading volumes fell (Apr was 65% lower than Mar).

The Bitcoin Ordinals protocol was created by Casey Rodarmour in Jan this year, allowing data, such as NFTs (non-fungible tokens), to be included in individual satoshis on Bitcoin. Then two months later, Domo, another developer, launched the experimental BRC-20 token, allowing minting of fungible tokens on the network. Both have generated a huge amount of excitement and activity, even though Domo himself has warned against investing real money in BRC-20, pointing out that it is still a proposal. There are over 24,000 tokens according to brc-20.io (http://brc-20.io). Developers have even managed to deploy a version of Uniswap on Bitcoin utilising BRC-20.

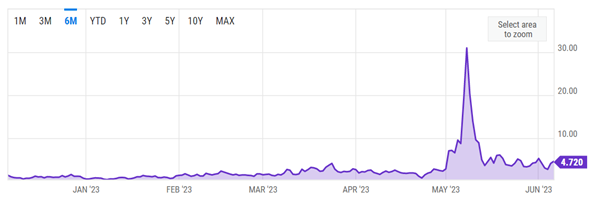

And it’s not just Bitcoin that is suffering. Ethereum gas fees are at their highest for a year because of memecoin mania. PEPE has been particularly popular, although recently PEPE’s value has dropped by 50%. Partly to blame are bots executing sandwich attacks, which are cashing in on the PEPE bubble. These bots work by searching the mempool (a queue that contains unprocessed transactions) for large orders, buying up tokens before those orders are executed, and then selling those tokens at a higher prices after they are executed (this is called front-running). This requires the bot to pay large gas fees to ensure that their transactions are executed first. One well known bot is run by jaredfromsubway.eth, estimated to have made somewhere between 4 and 40 million USD during the PEPE frenzy.

An interesting side effect of increasing Bitcoin fees is a renewed interest in Litecoin. Litecoin was designed to by ex-Google developer to be the “silver to Bitcoin’s gold”. The Litecoin price rose 7% last month, and the hash rate increased by almost 50%. Litecoin futures open interest has gone up by 22% since the start of the year.

Legal & Regulatory

The outlook for the US crypto industry continues to look bleak. Not only is the regulatory environment problematical for crypto companies, but now Biden is looking to impose additional taxes on crypto mining, equivalent to 30% of the energy costs, which would raise an additional $3.5 billion in tax revenue.

Speaking of US regulation, decentralised exchanges are increasingly coming under the spotlight. Gary Gensler, the chairman of the SEC, said that these services use a “false narrative” to avoid scrutiny, and that their “business models tend to be built on non-compliance”. Rostin Benham, the chairman of the CFTC, has also said that decentralised exchanges are not immune to US regulations.

Canada too, seems to be difficult for crypto companies. Both Binance and Bybit have announced that they are pulling out of Canada due to changes in regulation, following in the footsteps of a number of other exchanges who made similar announcements in April.

Meanwhile, in Europe, MiCA, which has been welcomed by many in the crypto industry, has been unanimously approved by the EU Council. MiCA (Markets in Crypto Assets) requires stablecoin issuers to hold a certain amount of capital reserves, and for wallet providers and exchanges to be licensed.

Staying with Europe, the ECB has finalised prototypes for a CBDC, in preparation for a decision whether to develop a digital Euro.

Companies & Products

We reported in April that Coinbase was looking to set up a crypto-derivatives exchange outside the US. Last month, Coinbase International Exchange was announced, based in Bermuda. It will offer perpetual futures denominated in BTC and ETH. The contracts initially offer up to 5x leverage. Coinbase are clearly making other attempts to branch outside the US; they have been speaking to regulators in Dubai, and met with Andrew Griffith, the UK’s Economic Secretary and City Minister. As well as derivatives, Coinbase have made other changes to their product lineup. They are retiring Coinbase Borrow, which allowed customers to borrow using BTC as collateral, are launching the Coinbase One subscription service which offers zero-fee trading for $30 a month, and have partnered with BitPanda to connect their US listed exchange to banks looking to offer digital assets to their European customers. Despite regulatory uncertainty in the US, Coinbase posted good Q1 results, with revenue up 22% at $736 million, and an EBITDA of $284 million, exceeding analysts estimations of $36 million.

Things at Binance have been more turbulent. Their spot market share fell to less than 50% for the first time since July last year. Binance had to pause BTC withdrawals twice on Sun 7th May, which caused some concern that this was due to large amounts of USD being withdrawn. Binance denied this, and said that it was due to high transaction fees (see this month’s headline), and that they would adjust their fee structure and work on integrating with Bitcoin’s Lightning Network.

Another exchange, Gemini, reported that a $630 million payment was missed by DCG to its subsidiary Genesis. Why does this concern Gemini? It’s because Genesis owes Gemini $900 million.

High transaction volumes also impacted the Ethereum network. Transactions could not be finalised for 3 epochs on Thu 11th May, and then again for 8 epochs the following day. The issue was caused by degraded performance from Prysm and Teku, which are two Ethereum validation clients. However, one positive is that this demonstrated the benefit of Ethereum’s diversity philosophy i.e. multiple clients.

The crypto winter and the US regulatory outlook continue to impact the industry adversely. Jane Street and Jump Capital both announced that they are downsizing their crypto efforts, with Jump Capital stating that it was pulling out of the US due to regulatory uncertainty.

On a more positive note, the Sui network went live on 3 May. Sui has generated a lot of interest because the company behind it, Mysten Labs, was formed by the team working on Meta’s (formerly Facebook) blockchain. Sui uses the Move language for smart contracts that was developed at Meta. The network has over 2000 nodes distributed across 43 countries, and was valued by pre-launch investors at $2 billion.

WorldCoin, the startup founded by Sam Altman, the OpenAI founder, has raised $115 million in series C funding, with backers including a16z and Bain Capital. WorldCoin is creating a cryptocurrency secured using iris scanning technology.

Talking of security, Ledger, the manufacturer of crypto hardware wallets, drew criticism for a new feature, Ledger Recover. Ledger Recover splits the seed phrase into three parts, and sends it to third parties, which reduces the risk of lost private keys. Critics, however, say that there is a risk that the seed phrase could be inferred by the third parties holding each of the parts. Ledger pointed out that users can opt out of this feature.

Crime

It has been a quiet month for crypto crime, perhaps those cyber criminals are outside enjoying the good weather. An attacker managed to infiltrate the DAO that manages Tornado Cash, the prominent mixer, giving them control over all governance decisions. The attacker withdrew 10,000 votes as TORN, Tornado Cash’s native token, and sold them for $4 million.

A Primer on Cross Chain Interoperability

There are a significant number of projects aiming to solve the problem of cross chain interoperability. Last month, there was a conference in Dubai organised by the IEEE focused solely on this topic. By understanding what it is, why it is important, and the different solutions, it helps us understand the investment potential of the tokens related to those projects.

Today, it is estimated that there are over 1000 different blockchains. Cross chain interoperability allows one blockchain to send assets and data to a different blockchain. This can be useful in the following situations:

- Bob does some work for Alice, and so Alice wants to pay Bob. Bob only has an Ethereum wallet. Alice only has a Bitcoin wallet

- Charlie wants to purchase an NFT that has been minted on Solana. However, Charlie holds the rest of his NFTs on Ethereum, and he would like to hold this one on Ethereum too

In the first example, Alice can pay Bob without cross chain interoperability, but it is hardly frictionless. Alice has to deposit BTC with an exchange, swap it for USD, swap the USD for ETH, and then send the ETH from the exchange to Bob’s wallet. If the exchange is centralised, then Alice has to trust the exchange. If the exchange is decentralised, Alice has to trust the decentralized exchanges’ smart contracts. There are many examples of smart contracts whose vulnerabilities have been exploited.

Developers of dApps also face the problem of making their applications compatible with multiple chains. By doing this, they increase adoption, and reduce the risks of technological obsolescence, network congestion, and excessive network fees. There are two approaches to solving this problem:

- Multi-chain: smart contracts that implement the functionality of the app are duplicated across multiple chains. This approach is more secure, but data cannot be passed across chains

- Cross-chain: data is passed across chains using some sort of bridge. This solution is considered by many to be less secure, but involves less effort for the dApp developer

There are two main approaches to solving cross chain interoperability. The first is cross chain bridges, and the second is layer zero networks. Let’s discuss these in greater depth.

Cross Chain Bridges

A cross chain bridge is a piece of infrastructure that enables the transfer of tokens across different blockchain networks. The bridge works by removing tokens from the source network, and adding tokens to the destination network. There are different mechanisms for moving assets across networks:

- Lock-and-mint: with this model, tokens from the source network are locked up, and new wrapped tokens (see below) are minted on the destination network

- Burn-and-mint: similar to lock-and-mint, but rather than locking up tokens from the source network, bridges of this type burn tokens from the source network

- Atomic swaps: this approach is different to the other two, in that users on the two networks exchange tokens with each other, with a smart contract as the intermediary

- Liquidity pools: LPs (Liquidity Providers) deposit a single asset into the liquidity pool (unlike DEX LPs, who deposit pairs, and are subject to impermanent loss), and receive an LP token. There are liquidity pools for each protocol. Users are then able to swap tokens using these liquidity pools

Bridges can also connect different types of network:

- L1 <-> L1 bridges: L1 (Layer 1) refers to the base level network, such as Ethereum or Bitcoin. These are the main networks that underlie an ecosystem. These types of bridges allow communication between those different ecosystems

- L1/L2 <-> L2 bridges: L2 (Layer 2) networks sit on top of L1 networks. They typically exist to increase the scalability of the L1 network by allow the L1 network to offload some of its transactions

Finally, bridges can have different levels of centralisation:

- Trusted bridges: this type of bridge depends on a central authority or system, which requires that users trust that authority

- Trustless bridges: in contrast, this type of bridge is decentralised, and operates using smart contracts

With lock-and-mint and burn-and-mint, there is the question of how the assets themselves will be represented on the target network. This is where wrapped tokens come in. A wrapped token is a representation of a token on a different blockchain, that can be swapped 1:1 for the original token i.e. it has exactly the same value as the original token. The first and most best known wrapped token is WBTC (Wrapped Bitcoin), which is an ERC20 token that represents BTC on the Ethereum network.

Examples of cross chain bridges are:

- Connext: formerly xPollinate, Connext is a trusted bridge that depends on atomic swaps. It supports Ethereum, Binance Smart Chain, Polygon, Gnosis, Optimism and Arbitrum

- Wormhole: initially created to bridge Ethereum and Solana, Wormhole is a trustless lock-and-mint bridge, supporting 14 protocols, including Binance Smart Chain, Polygon and Avalanche. Cross chain messages are validated by 19 Guardians (nodes)

- Stargate: built on top of LayerZero, a cross-chain messaging infrastructure, Stargate uses a liquidity pool. Stargate supports three stablecoins (USDT, USDC, BUSD) on seven different networks (Ethereum, Binance Smart Chain, Avalanche, Polygon, Arbitrum, Optimism, Fantom). A unique feature of Stargate is the unified liquidity pool, which uses the Delta Algorithm to rebalance liquidity pools across chains

Layer 0 Networks

Another approach to solve cross chain interoperability is to create a common set of services that are used to build blockchains, and to put those into an infrastructure layer, called Layer 0. Any blockchains built using those Layer 0 services are then able to interoperate. These Layer 0 networks don’t just address interoperability; they can also provide a solution to Layer 1 scaling issues by allowing Layer 1 to delegate functions to the Layer 0 network.

Examples of Layer 0 protocols are:

- Polkadot: created by Gavin Wood, Ethereum Co-Founder. The Layer 0 chain is called the Polkadot Relay Chain, and the Layer 1 chains that are built on top are called parachains. The relay chain provides, by design, a minimal set of functionality (for example, smart contracts are not supported). Polkadot uses proof of stake (PoS) to validate transactions. Projects that want to implement a parachain bid in auctions for slots. Polkadot’s native token is DOT

- Avalanche: developed by researchers from Cornell University. Avalanche uses its own proprietary consensus algorithm, which is based on proof-of-stake, but is much, much faster. Users can set up their own subnets, and then create their own blockchains within those subnets. Blockchains within a subnet can interoperate. Avalanche has its own subnet, the primary subnet, which comes with 3 blockchains. These are:

- X-Chain: used for transactions

- C-Chain: used for creation and execution of smart contracts

- P-Chain: used for staking AVAX (Avalanche’s native token)

- Cosmos: independent blockchains, called “zones”, can be created on top of the Tendermint proof-of-stake L0 protocol, using the Cosmos SDK (software development kit). These zones can communicate via the Cosmos Hub, a blockchain itself, using the Inter-Blockchain Communication Protocol (IBC). The native token of the Cosmos Hub is ATOM.

About Us

DeQuantifi is a consultancy that builds bespoke risk, pricing and other quantitative software solutions for organisations that trade crypto. What sets us apart from our competitors is that we leverage our proprietary crypto library to deliver value quickly whilst making sure that the solution is tailored to you.

The material provided herein is for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.